Mars contribution

From capital to pension.

Mars provides the foundation – this also applies to the payout: The balance accumulated in Steps 1 and 2 is always recalculated into regular pension payments. This way, Mars makes an important contribution so you can maintain your standard of living also in retirement..

Insurance-mathematical principles are applied in the calculation. That means, various factors are figured in, among others, the statistical life expectancy and actuarial interest rate and if you included survivor’s benefits in your plans – see below for more information.

The statistical life expectancy is also the reason why your pension is lower if you retire before the age of 65. Because the benefits then have to be paid over a longer period of time. So, the earlier you retire, the lower your monthly pension.

Providing for your family

Prior to drawing retirement benefits, you can decide: Do you want to continue providing for your partner after your death with survivor’s benefits? You can make sure your spouse, registered common-law partner or cohabitant (partner in a marriage-like relationship) is protected as well. After your death, he or she will receive 60% of your last retirement benefit. However, this also decreases your retirement benefit.

By the way: During your working life, your family is automatically protected in case of your death – find out more under Risk.

A steady increase

Your retirement benefit will be raised year on year by 1%.

Your contribution

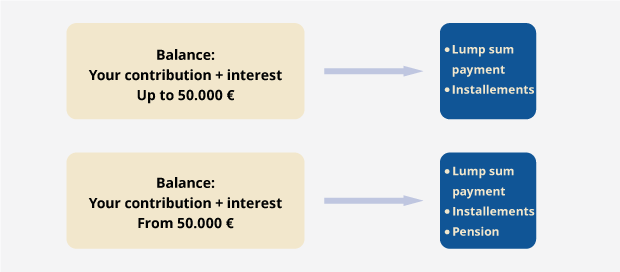

Lump sum, installments or pension? That depends!

And that depends on your financial planning and your deposit balance. If the balance based on your contribution amounts to 50,000 euro or less, you may choose between a lump-sum payment and installments. When your balance is higher than 50,000 euro, you also have the option of a monthly, lifelong pension. And what’s best: You can combine these options as you see fit!

Please remember: each of these payout options has a different impact on taxes. So, you had better discuss it with your tax advisor.

One-off, lump sum

Going for the one-off, lump sum payout? This will be paid in the month following the official start of your retirement. If you want the amount to be paid at a different time, please contact the Mars Pension Service well ahead of time.

By the way, if your accumulated capital is not paid immediately following the start of your retirement, it will draw interest until the payout. The actuarial interest rate applied is aligned to the yield on government bonds outstanding with a medium remaining maturity of four to five years as published by the German Bundesbank. However, the actuarial interest rate determined in the quarter of the year when the participants or former participants retire will remain unchanged until the last payment has been made. The participant or former participant is informed about the actuarial interest rate when requesting pension benefits as a lump-sum payout.

Installments

This is a very flexible option: You agree with Mars on how many installments you want to have paid – either up to 10 annual OR up to 120 monthly payments. You can decide the best fit for your financial planning.

Payments begin the month when your retirement officially begins. You can also agree on a later first payout date (latest January of the year following the start of your retirement) should you choose annual installments. This may be better for tax reasons – please consult with your tax advisor!

Any outstanding installments earn interest based the current actuarial interest rate. You will be told what the interest rate is at the beginning of your payout period.

Irrespective of the rate of interest, every annual installment is raised by 1% versus the previous one. Monthly installments are also increased by 1% every 12 months.

If you die before all installments are paid, then your survivors will receive any outstanding payments. Survivors include your spouse, your registered common-law partner, your designated permanent partner or all children entitled to a child allowance.

Pension

If you decide in favor of a pension, Mars will deposit your balance in an insurance plan that recalculates the total amount into a lifelong pension. The amount of your regular pension depends on the statistical life expectancy and the insurance rate. You can also opt to have survivor’s benefits for your spouse or registered common-law partner figured into the calculation, the same as with the pension based on Mars contributions. Then your partner will receive 60% of your last retirement benefit after your death. However, the same rule applies: opting for survivor’s benefits will decrease your own pension..

Your pension will be raised year on year by 1%.

Mars Pension Service

WTW AV 2 Mars Pension Service Mailbox 124 72102 Rottenburg a. Neckar Telephone: +49 611 585-82 530 Telefax: +49 611 794-44 28 Mo-Fr 09:00-12:00 Uhr mars-pension-service@wtwco.com

Pension Portal online

Calculate your pensions with help of the Mars Retirement Portal. Please have your Log-In-Data at hand!

Go to portal