Pension in 3 steps

Step 1

We build the foundation together.

In Step 1, both of us pay in: You and Mars each contribute a fixed amount. Of course, your contribution is voluntary – but: No contribution from you, no contribution from Mars. That means if you decide not to participate, you are giving away money – and missing a golden opportunity to build a financial foundation for the future with attractive conditions.

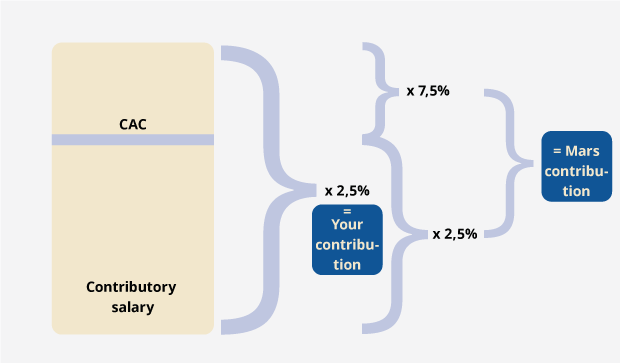

This is how your fixed amount is calculated

Your fixed contribution is defined as 2.5% of your contributory gross annual income. Your contributory income includes: base pay, reliability bonus, company bonus, shift allowance, responsibility bonus, ARB, overhead bonus and annual variable pay (AVP) up to 100% target achievement. All other types of pay (e.g. overtime compensation or accrued time account) are excluded from the calculation.

Important: the contribution is tax-free. This means the net amount you pay is much lower.

Your annual contribution is recalculated into monthly contributions; these are automatically withheld from your salary. To check on the current level of your contributions and your contributory income go to the Pension Portal.

This is how the Mars contribution is calculated

Mars matches the amount: 2.5% of your contributory gross annual income.

f your income is above the (statutory) contribution assessment ceiling (CAC), you receive 2.5% on your income up to the CAC, plus 7.5% contributed for the income proportion above the CAC. Background: The CAC is the assessment ceiling or upper limit of income for which contributions are deducted and paid into the state social security system. This means: If your pay is above the CAC, you don’t accumulate any (statutory) pension rights for the income proportion above this ceiling. So, your retirement gap is particularly wide.

Step 2

Take the incentive.

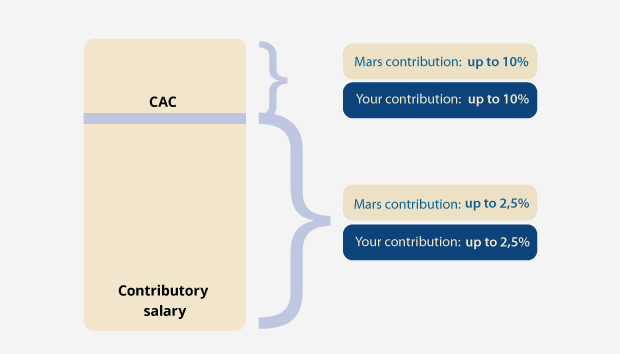

In Step 2, you decide how much you want to invest in your retirement provision. Best of all: The Mars benefit increases at the same rate as your investment. Because Mars will double your contribution.

Contribution limits: at this level you may contribute a maximum of 2.5% of your contributory annual income that is below the CAC, in addition up to 10% of your remaining income that is above the CAC.

Your annual contribution is recalculated into monthly contributions; these are automatically withheld from your salary.

Remember: Due to the tax advantage your net contribution is much lower than the gross contribution actually deposited in the Mars Pension Plan.

Determine your contribution and remain flexible

You determine how much want to contribute while adhering to the contribution limits. Mars matches the contribution. After that, you may adjust or suspend your contribution once a year. Just go to the Pension Portal and off you go.

Step 3

You close the gaps.

Looking to close the retirement gap even more? Then go to Step 3! You can increase your contributions even further by up to a maximum of 20% of your contributory income in all three steps together.

While there are no matching Mars contributions, you will of course still benefit from the same attractive interest and tax benefits – because your contribution to Step 3 is also withheld from your gross income.

Your annual contribution is recalculated into monthly contributions; these are automatically withheld from your salary.

Time equals money equals future security

Recreation is important! That is why you get leave time. You have to take 24 days p.a. of leave time – a legal requirement. Sometimes, you may have leave days left or time accrued on your flexi account. This is where the Mars Pension Plan comes into play.

This is because in Step 3 you can also make contributions from the associate savings scheme, accrued time account or annual leave. Payroll will calculate your time into money.

Please note: Converting time into money for the retirement pension is not initiated through the Pension portal, but entered via the time-keeping system X-Time Web.

Mars Pension Service

WTW AV 2 Mars Pension Service Mailbox 124 72102 Rottenburg a. Neckar Telephone: +49 611 585-82 530 Telefax: +49 611 794-44 28 Mo-Fr 09:00-12:00 Uhr mars-pension-service@wtwco.com

Pension Portal online

Calculate your pensions with help of the Mars Retirement Portal. Please have your Log-In-Data at hand!

Go to portal